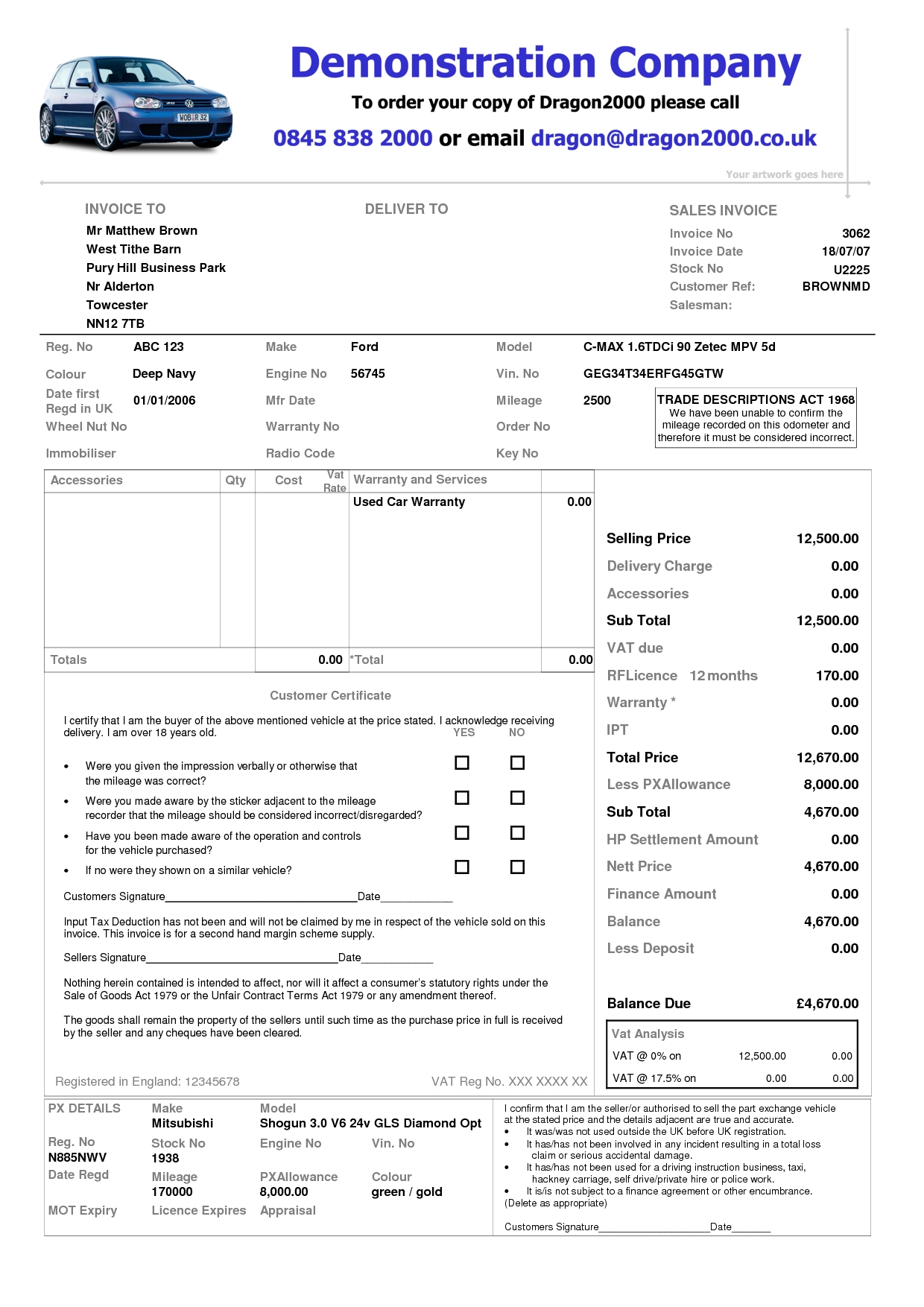

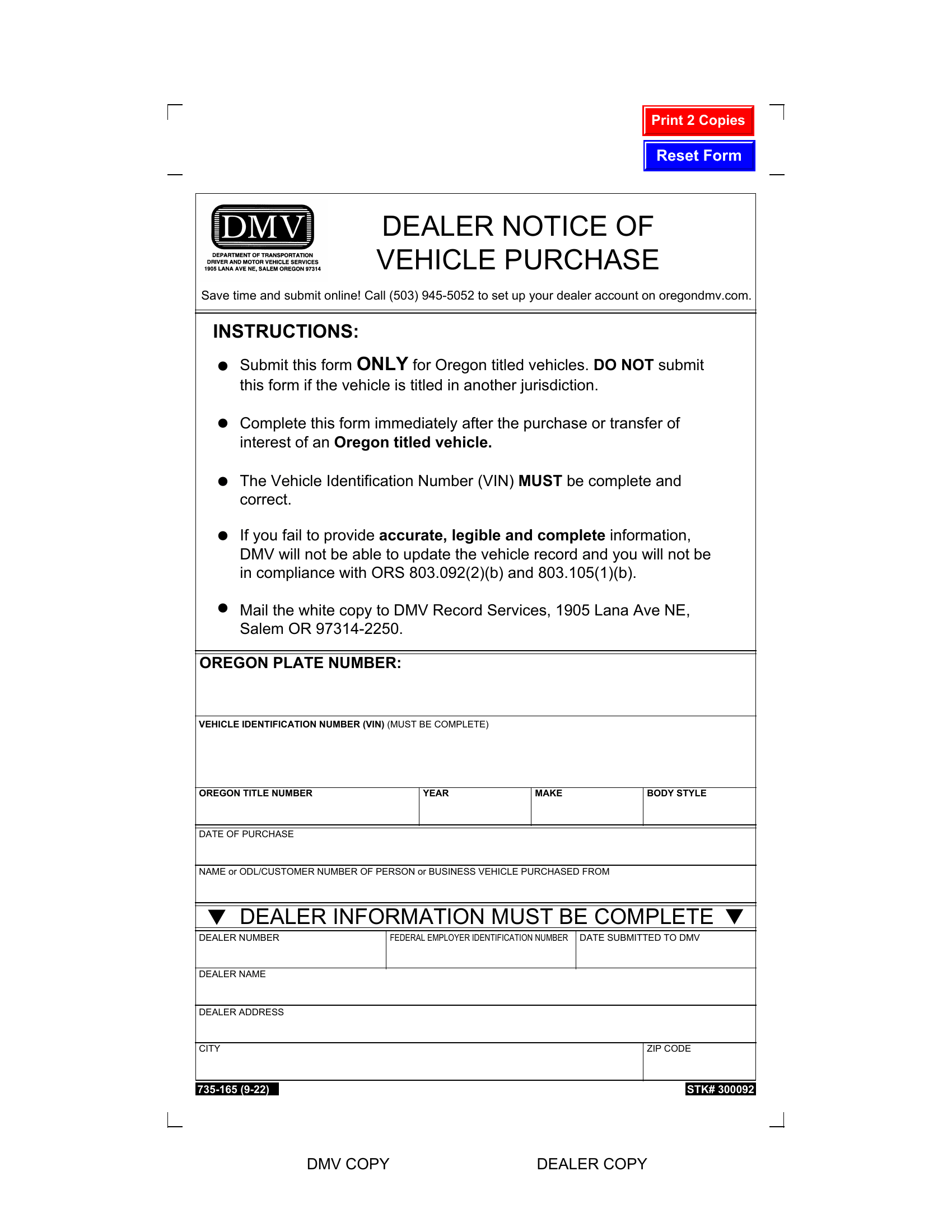

Weba motor vehicle purchased in texas to be leased is subject to motor vehicle sales tax. The lessor is responsible for the tax, and it is paid when the vehicle is registered at the local. Webjan 26, 2012 · texas car tax is going to vary because of city, county and state taxes. Each city has their own rates of taxation, as do the counties as well. The best way to figure. Webtexas sales tax on car purchases: Vehicles purchases are some of the largest sales commonly made in texas, which means that they can lead to a hefty sales tax bill. Webusing the texas auto tax calculator is simple: Input basic information about your vehicle, such as make, model, year, and purchase price. Webmotor vehicle sales tax is the purchaser’s responsibility. If the seller is not a texas licensed dealer, the purchaser is responsible for titling and registering the vehicle, as.

Related Posts

Recent Post

- Mls Listing Nj

- Ktvu Reporters

- Nuvance Health Schedule Appointment

- Twin Cities Obituaries Pioneer Press

- Everloved Obituary Reviews

- Heartland 10x12 Shed

- Easiest Gang Signs

- Cch Prosystem Fx

- Okc Section 8

- Providence Tranny

- Remote Jobs 100k No Experience

- Brigham And Womens Hospital Primary Care Doctors

- Lab Corp Patient Sign In

- Sig Sauer P365 Grip Module With Safety

- Iheartradio Win 1000 Dollars

Trending Keywords

Recent Search

- Regency Prep Sink

- Tucson Police Auction

- How To Create A Return Label In Shipstation

- Nissan Driving Jobs

- Camping World Stadium Plaza Level

- Scroller Fun With Friends

- Steelton Sink

- Religious Meaningful Forearm Tattoos

- Rock Truck Driver Jobs

- Power Outage In Coventry Ri

- 2x2 Furring Strips

- Crate And Barrel Mid Century Dining Table

- Wright Stander 48 Price

- Delivery Driver Jobs In Atlanta Ga

- Interior Window Shutters Lowes